Consider these reasons to review insurance policies:

- Policies may not be performing as projected due to market downturns, decreasing interest rates, and market volatility.

- Newer products might be more cost-efficient or offer better guarantees (lower premium for same coverage or more coverage for same premium).

- Guaranteed Death Benefit Universal Life is a new type of life insurance product that can often provide the same guaranteed death benefit as Whole Life at a lower cost.

- Insurer financial ratings changes put policies at risk if the backing company is at risk.

- Company financials may have changed; A buy-out based on the valuation of the company will need to be evaluated for an increase in the company value, otherwise any buy-sell agreement may be invalid.

- Actuarial tables change periodically, and pricing is better with new products.

- Policy was sold in a vacuum without competition.

- Policies may be at risk of lapsing, leaving the trust beneficiaries with nothing and you with potentially a major liability for failing to properly monitor the policies.

- Underwriting changes may have occurred. What was once considered rated for underwriting purposes might be standard today and cost less.

- Improved health or lifestyle changes may have occurred, providing the potential for better underwriting offers and lower premiums.

- The amount of life insurance needed might now be larger, making current coverage insufficient. Or, conversely, the need for the payout may be much lower than when the policy was first secured.

- Policy may no longer be needed and a better value for the client may be derived by selling it in the secondary market.

Case Study #1

Trust-holding fixed insurance products

Charlie and Stella set up their estate plan 10 years ago. As part of the plan, they set up an irrevocable trust and the trustee purchased two second-to-die policies on their lives from two different companies. One was a participating Whole Life contract, and the other was a Universal Life contract. The couple diligently made gifts for premium payments each year, and the trust worked well. However, nobody – including the trustee – had reviewed the life insurance policies.

At the urging of their life insurance advisor and their CPA, Charlie and Stella contacted the trustee and asked to have the policies reviewed. As it turned out, both policies were not performing as expected. Both were sold to them using assumptions that, while reasonable for the economic climate 10 years ago, were unrealistically high in today’s environment. The Universal Life policy was being credited at a rate 5.5% lower than the illustration on which the policy was sold. A 1035 exchange of the two policies into a single lifetime guaranteed second-to-die policy with an increased death benefit where premiums would only be due for the originally scheduled number of years.

Case Study #2

Estate increased substantially

John and Sarah did their estate planning 15 years ago. Back then, it was determined that they had an estate liquidity need of $5 million. As a result, they established an irrevocable trust and had the trust purchase $5 million of second-to-die coverage on their lives. Since their original estate planning, their estate increased in value by $10 million. As a result of a policy review, it was discovered that the amount of their existing trust-owned life insurance was not enough to provide the estate liquidity they desired. Using financing, John and Sarah were able to purchase the $10 million in death benefit without increasing their out-of-pocket costs.

Case Study #3

Market effects variable policies

George and Martha had a variable policy guaranteed up to age 90. They were now 75 and 74 years old, respectively. They knew the policies were variable and became worried about what a market downturn at the wrong time could do to the death benefit. A guaranteed death benefit to at least age 100 was very important to them. As owners of a commercial real estate business, they wanted to remove the market risk component from their Life Insurance.

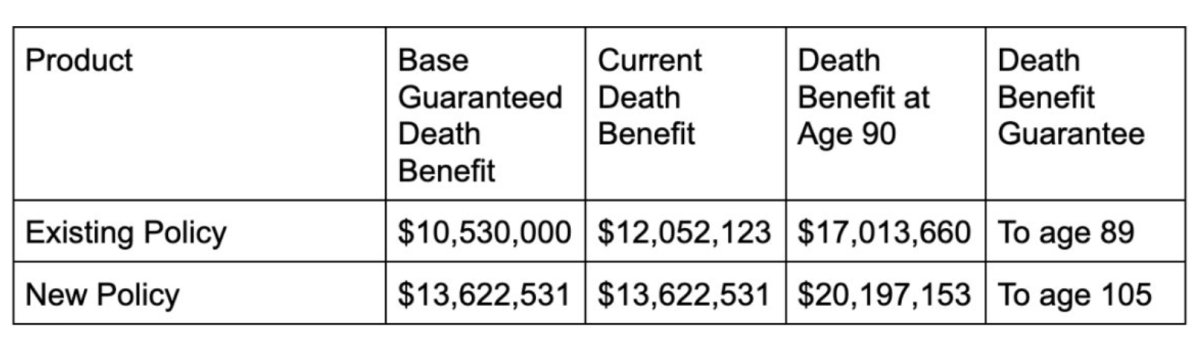

After looking at and rejecting a Guaranteed Universal Life, they chose a Guaranteed Indexed Universal Life with the following results:

74-Year-Old Female Preferred Non-Tobacco, 75-Year-Old Male Standard Non-Tobacco;

$1,071,718 1035 Exchange & $345,668 Annual Premium

They originally had a variable policy guaranteed to age 89. The new policy not only significantly increased their death benefit, but guaranteed a death benefit to age 105.

We have the resources to help you:

- Examine a trust’s current coverage

- Compare the current coverage to the trust’s anticipated needs

- Compare the current coverage to a newer, alternative policy

- Offer cash flow solutions that enable the purchase and maintenance of life insurance policies

The many moving parts of your estate – business, heirs, real estate, philanthropy, investments – need to be orchestrated in concert to maximize your legacy and reduce your loss to estate taxes. This requires significant inter-disciplinary expertise to realize the benefits and avoid the pitfalls. Planning Network Partners is dedicated to examining this and other opportunities as part of a larger picture of your whole financial health.

Contact Us today for expert assistance.